| April 2022 on going | |

| Statistics | |

| GDP | 80.7 billion (2020) [1] |

GDP growth | -3.6% 2020 [1] |

GDP per capita | 3,682 (2020) [1] |

| External | |

Gross external debt | $54.3bn with private [2] |

| Public finances | |

| -12.8 % (2021 est) [2] | |

All values, unless otherwise stated, are in US dollars. | |

Sri Lanka declared the country was suspending payment on most foreign debt from April 12, 2022, kindling the Indian Ocean island's first sovereign default event and ending an unblemished record of repaying external debt despite experiencing milder currency crises in the past.[3][4] By April Sri Lanka was suffering the worst monetary crisis in its history with a steeply falling rupee, high inflation and forex shortages which triggered shortfalls of fuel, power and medicine. Widespread public protests led to a political crisis. In March, the International Monetary Fund released a report saying publicly for the first time that the country's debt was unsustainable and required re-structuring. Authorities had advertised for financial and legal advisors to help negotiate with creditors shortly before the suspension was announced.[2][5]

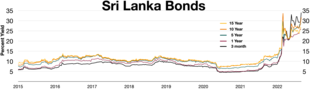

Inverted yield curve in the first half of 2022

- ^ a b c "2020 Annual Report - Central Bank of Sri Lanka" (PDF). Central Bank of Sri Lanka. Retrieved 15 April 2022.

- ^ a b c "Sri Lanka - STAFF REPORT FOR THE 2021 ARTICLE IV CONSULTATION". imf.org. International Monetary Fund. Retrieved 15 April 2022.

- ^ "Interim Policy Regarding the Servicing of Sri Lanka's External Public Debt". treasury.gov.lk. Sri Lanka Finance Ministry. Retrieved 15 April 2022.

- ^ "Sri Lanka halts foreign debt repayments in 'pre-emptive negotiated default'". Economynext.com. 12 April 2022. Retrieved 15 April 2022.

- ^ "Request for Proposals - Financial Advisor & Legal Consultant". treasury.gov.lk. Sri Lanka Finance Ministry. Retrieved 15 April 2022.